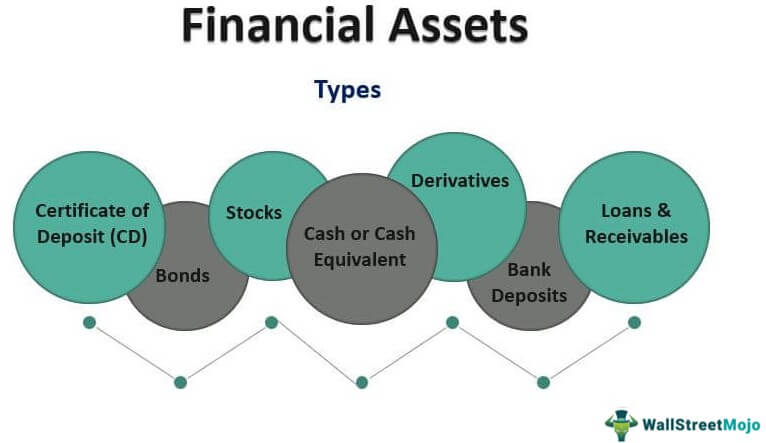

With the majority of financial assets with a maturity date in the contract, cashing out too early can cost the investor financial penalties. Financial assets such as stocks, retirement accounts, and bonds would to change without 2020 be considered investments. It could be a vehicle, a house, a lawn mower, or a piece of land, for example. There can be a lot of terms thrown around when speaking about assets and it can sometimes be confusing.

IFRS 9 Financial Instruments

Exchange-traded derivatives on these instruments are traded in the form of fixed-income futures and options. It’s easy to get started when you open an investment account with SoFi Invest. You can invest in stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, and more. SoFi doesn’t charge commissions, but other fees apply (full fee disclosure here).

Share this:

A portfolio investment may be either strategic—where you buy financial assets with the intention of holding onto those assets for a long time, or tactical—where you actively buy and sell the asset hoping to achieve short-term gains. A portfolio is a collection of financial investments like stocks, bonds, commodities, cash, and cash equivalents, including closed-end funds and exchange-traded funds (ETFs). In November 2009 the Board issued the chapters of IFRS 9 relating to the classification and measurement of financial assets. In October 2010 the Board added the requirements related to the classification and measurement of financial liabilities to IFRS 9. This includes requirements on embedded derivatives and how to account for changes in own credit risk on financial liabilities designated under the fair value option. Real estate can provide a nice nest egg and current or future income, but the real estate owner must also pay property taxes and sometimes management fees, maintenance costs and a mortgage.

Related Stocks

A life insurance rider adds specific benefits or coverage adjustments to a standard policy. A good portfolio will depend on your investment style, goals, risk tolerance, and time horizon. Generally speaking, a good degree of diversification is recommended regardless of the portfolio type, in order to not hold all of your eggs in one basket. Although a financial advisor can create a generic portfolio model for an individual, an investor’s risk tolerance should significantly reflect the portfolio’s content.

- The business’s other assets might include real estate, office property, vehicles, inventory and even books of business (the client base).

- However, It’s important to do your homework and consider the risks involved since automated platforms are not fully customized to each individual’s specific needs.

- In December 2011 the Board deferred the mandatory effective date of IFRS 9.

- Maintaining funds in liquid financial assets can result in greater preservation of capital.

- As an investor, you’re also likely to hear about the importance of “asset allocation” or “asset management” for your portfolio.

“Analytics’ third quarter results tracked our expectations, delivering high-single digit recurring revenue growth and progressive margin expansion,” said Jim Hannon, Chief Executive Officer. “I’m incredibly proud of the resilience and innovation our team has shown this year. They have successfully navigated challenging macroeconomic conditions, delivering consistent recurring revenue growth, operational improvements, and new product innovations that will continue to drive value for our clients. The solid execution of our strategy leaves us strongly positioned to capitalize on market improvements and evolving client needs.” Deciding whether a family income rider is right for you involves evaluating your personal and financial situation.

The Importance of Asset Liquidity

There can be as many different types of portfolios and portfolio strategies as there are investors and money managers. You also may choose to have multiple portfolios, whose contents could reflect a different strategy or investment scenario, structured for a different need. The Phase 2 amendments apply only to changes required by the interest rate benchmark reform to financial instruments and hedging relationships. Interest Rate Benchmark Reform also amended IFRS 7 to add specific disclosure requirements for hedging relationships to which an entity applies the exceptions in IFRS 9 or IAS 39. Financial instruments can be categorized by asset class and as cash-based, securities, or derivatives.

Some investors check in on their portfolio regularly (monthly, quarterly or annually) and adjust it if necessary. For example, under the general depreciation system (GDS), the Internal Revenue Service (IRS) assigns office furniture and fixtures a useful life of seven years, while cars and trucks get a useful life of five years. The EAR accounts for the impact of interest compounding over the year, ensuring that the interest rate per payment period reflects the true cost of borrowing. These are the cash reserve of the organization with Banks in saving and checking accounts. On a consolidated basis, revenues were $128.4 million, up 3.2% (1.4% on a Constant Currency basis) and Adjusted EBITDA was $21.6 million, up 27.0% (23.5% on a Constant Currency basis). Adjusted EPS was $0.19, compared to $0.14 in the third quarter of 2023.

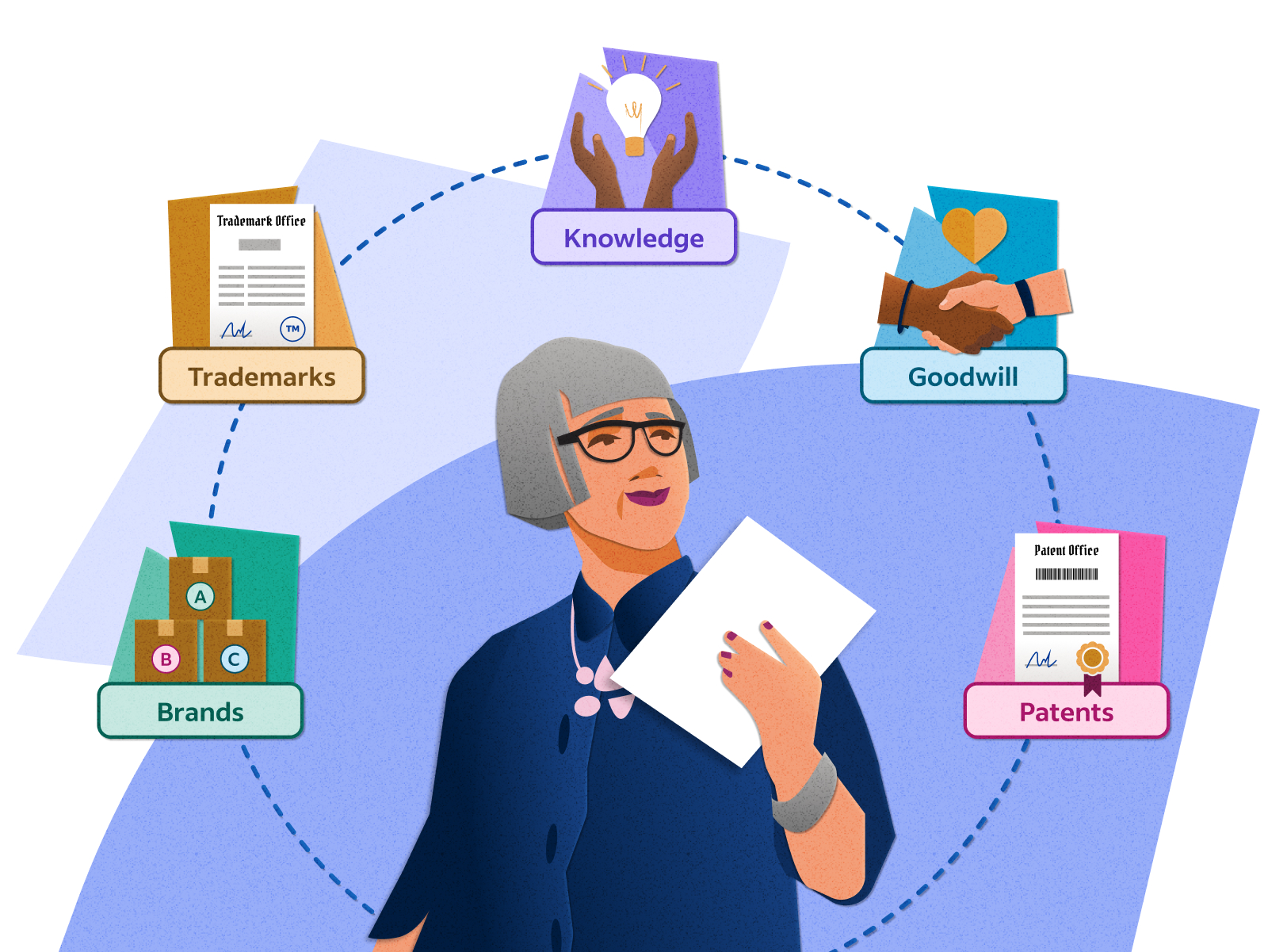

Long-term assets can be such things as stock and bonds, as well as fixed assets such as property and real estate. Long-term assets also include intellectual property such as copyrights and patents. Financial assets can include stocks, corporate and government bonds, and other types of securities. Unlike fixed assets, they tend to be liquid, and they are valued according to their current price on the relevant market.

By integrating a family income rider into an insurance plan, policyholders ensure their loved ones receive a steady income stream, aiding in financial management and planning after their passing. Financial Assets are intangible assets such as bank deposits, bonds, and stocks, whose values are derived from a contractual claim of what they represent. Unlike property or commodities, they are not physical (apart from the documents’ paper). Financial assets are important because they allow for faster cash conversion compared to real or intangible assets which are more illiquid investments.

Building a hybrid portfolio requires taking positions in stocks as well as bonds, commodities, real estate, and even art. Generally, a hybrid portfolio entails relatively fixed proportions of stocks, bonds, and alternative investments. This is beneficial, because historically, stocks, bonds, and alternatives have exhibited less-than-perfect correlations with one another. Exchange-traded derivatives are traded for short-term, debt-based financial instruments such as short-dated interest rate futures. There also are OTC derivatives such as forward rate agreements (FRAs). Financial instruments can be real or virtual documents representing a legal agreement involving any kind of monetary value.

As mentioned, financial assets are generally the most liquid of the three. For example, bank deposits and stocks can be converted to cash within a week in most cases, while real estate and equipment has to be listed before it can be sold. Maintaining funds in liquid financial assets can result in greater preservation of capital. Money in bank checking, savings, and CD accounts are insured against loss of up to $250,000 by the Federal Deposit Insurance Corporation (FDIC) for credit union accounts. If for some reason the bank fails, your account has dollar-for-dollar coverage up to $250,000.